All Categories

Featured

Table of Contents

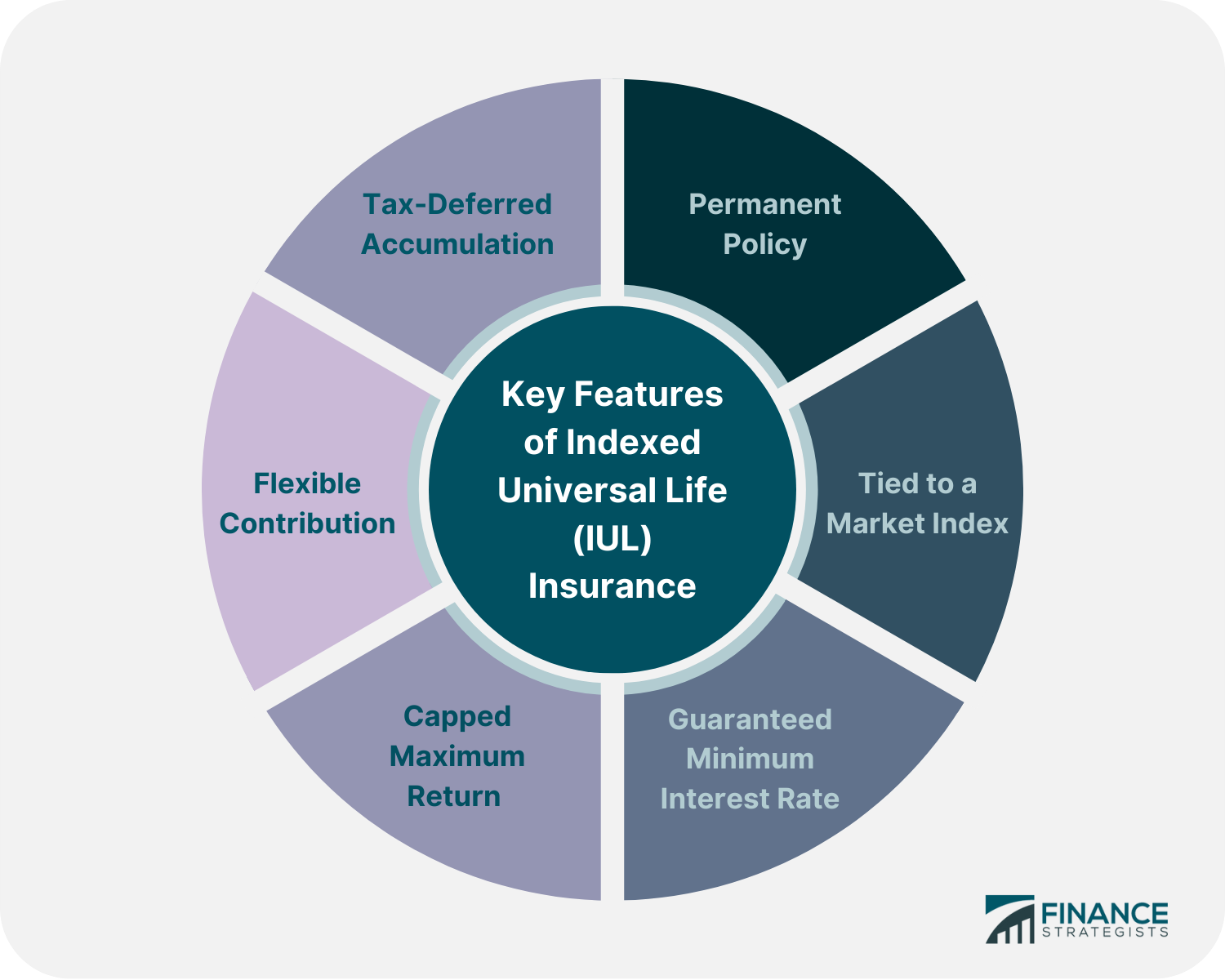

Indexed Universal Life (IUL) insurance coverage is a sort of long-term life insurance coverage plan that integrates the functions of standard global life insurance with the possibility for cash value growth linked to the efficiency of a stock exchange index, such as the S&P 500 (Guaranteed Indexed Universal Life). Like various other types of irreversible life insurance coverage, IUL offers a survivor benefit that pays out to the beneficiaries when the insured passes away

Cash money value build-up: A portion of the costs payments enters into a cash value account, which earns rate of interest over time. This cash value can be accessed or borrowed versus during the insurance holder's life time. Indexing choice: IUL plans supply the chance for cash value development based on the efficiency of a supply market index.

What is a simple explanation of Indexed Universal Life Accumulation?

Just like all life insurance policy items, there is additionally a collection of dangers that insurance holders should understand prior to considering this kind of plan: Market threat: One of the primary risks linked with IUL is market risk. Because the cash money value development is linked to the efficiency of a securities market index, if the index chokes up, the money worth might not expand as anticipated.

Adequate liquidity: Insurance holders need to have a steady monetary situation and be comfortable with the exceptional repayment requirements of the IUL plan. IUL allows for adaptable costs repayments within certain limitations, however it's important to preserve the plan to ensure it attains its intended goals. Passion in life insurance policy coverage: Individuals that need life insurance coverage and an interest in cash worth growth might discover IUL appealing.

Prospects for IUL need to have the ability to recognize the auto mechanics of the policy. IUL may not be the most effective choice for people with a high tolerance for market threat, those that prioritize inexpensive financial investments, or those with even more immediate economic needs. Consulting with a certified financial consultant that can provide customized assistance is necessary prior to thinking about an IUL plan.

All registrants will certainly get a calendar invite and link to join the webinar via Zoom. Can not make it live? Register anyhow and we'll send you a recording of the discussion the next day.

Who offers flexible Indexed Universal Life Policyholders plans?

You can underpay or miss costs, plus you may be able to readjust your death benefit.

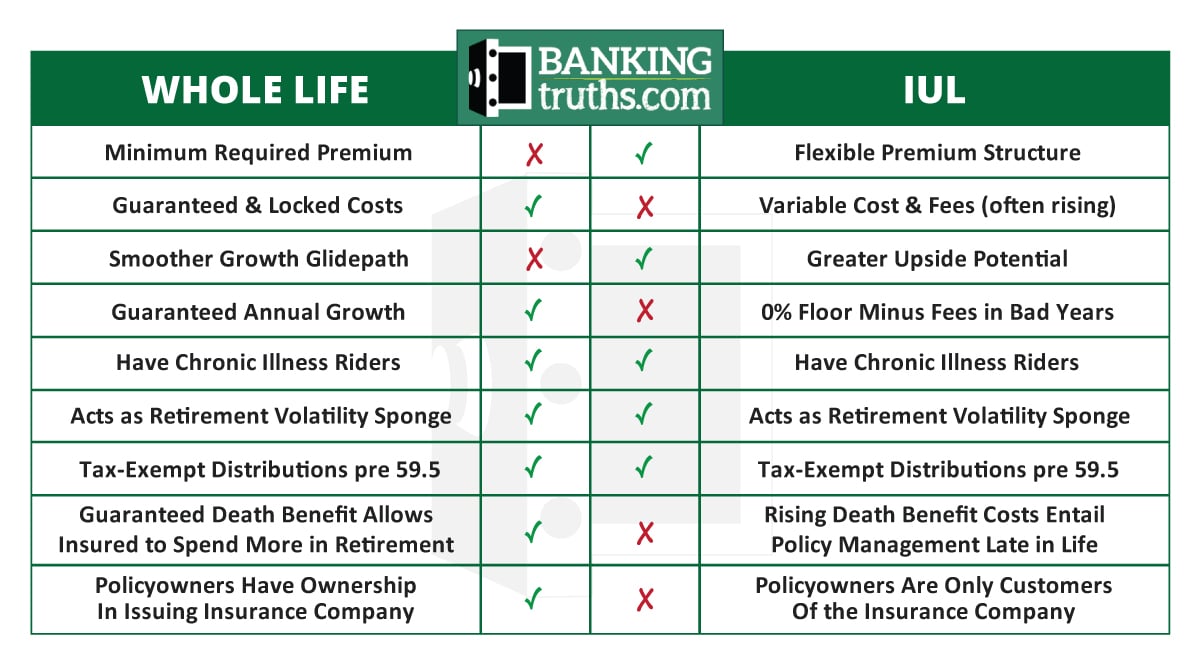

Versatile premiums, and a death benefit that may also be flexible. Cash worth, together with prospective development of that worth with an equity index account. IUL vs whole life. A choice to allot component of the cash money worth to a fixed rate of interest alternative. Minimum rate of interest guarantees ("floorings"), however there might likewise be a cap on gains, commonly around 8%-12%. Gathered cash money worth can be utilized to reduced or potentially cover costs without subtracting from your death benefit.

Policyholders can determine the percentage allocated to the dealt with and indexed accounts. The worth of the selected index is taped at the start of the month and compared with the value at the end of the month. If the index raises during the month, rate of interest is included in the cash value.

The resulting interest is included to the cash money value. Some plans compute the index gets as the sum of the adjustments for the duration, while various other plans take an average of the everyday gains for a month.

High Cash Value Indexed Universal Life

The price is set by the insurer and can be anywhere from 25% to greater than 100%. (The insurer can likewise transform the get involved price over the life time of the policy.) If the gain is 6%, the involvement price is 50%, and the existing cash value total is $10,000, $300 is included to the money value (6% x 50% x $10,000 = $300).

There are a variety of benefits and drawbacks to consider prior to acquiring an IUL policy.: As with common universal life insurance policy, the policyholder can raise their costs or reduced them in times of hardship.: Amounts credited to the cash money value grow tax-deferred. The cash money value can pay the insurance coverage premiums, enabling the insurance holder to decrease or stop making out-of-pocket costs payments.

What does a basic Iul Premium Options plan include?

Several IUL policies have a later maturity date than various other types of universal life policies, with some finishing when the insured reaches age 121 or even more. If the insured is still to life back then, plans pay the survivor benefit (but not generally the cash money value) and the earnings might be taxed.

: Smaller sized plan face values do not offer much advantage over normal UL insurance policy policies.: If the index goes down, no passion is attributed to the cash worth. (Some policies provide a reduced assured rate over a longer period.) Various other financial investment lorries make use of market indexes as a benchmark for performance.

With IUL, the goal is to make money from upward activities in the index.: Because the insurance provider just purchases alternatives in an index, you're not directly bought stocks, so you do not benefit when companies pay dividends to shareholders.: Insurers cost fees for managing your cash, which can drain pipes cash money worth.

What are the top Iul For Wealth Building providers in my area?

For a lot of individuals, no, IUL isn't far better than a 401(k) - IUL accumulation in regards to saving for retirement. The majority of IULs are best for high-net-worth people seeking means to reduce their taxed earnings or those that have maxed out their various other retired life choices. For everyone else, a 401(k) is a better investment vehicle because it doesn't lug the high fees and costs of an IUL, plus there is no cap on the quantity you may make (unlike with an IUL policy)

While you might not lose any money in the account if the index drops, you won't make passion. If the marketplace transforms favorable, the revenues on your IUL will not be as high as a common financial investment account. The high cost of costs and charges makes IULs expensive and substantially less budget-friendly than term life.

Indexed global life (IUL) insurance offers cash money worth plus a survivor benefit. The money in the cash money worth account can make passion with tracking an equity index, and with some usually allocated to a fixed-rate account. Indexed global life plans cap just how much money you can collect (frequently at much less than 100%) and they are based on a potentially volatile equity index.

What is the difference between Iul Loan Options and other options?

A 401(k) is a far better alternative for that function because it does not bring the high charges and costs of an IUL policy, plus there is no cap on the quantity you might gain when invested. Most IUL policies are best for high-net-worth people seeking to reduce their gross income. Investopedia does not offer tax, investment, or financial solutions and recommendations.

If you're thinking about buying an indexed universal life plan, initial speak to a monetary consultant that can explain the subtleties and give you an accurate image of the actual capacity of an IUL policy. Make sure you understand just how the insurer will determine your rates of interest, profits cap, and costs that could be evaluated.

Table of Contents

Latest Posts

Iul Vs Roth Ira

Maximum Funded Indexed Universal Life

Insurance Company Index

More

Latest Posts

Iul Vs Roth Ira

Maximum Funded Indexed Universal Life

Insurance Company Index